RESTAURANT EMPLOYEE RELIEF FUND (RERF)

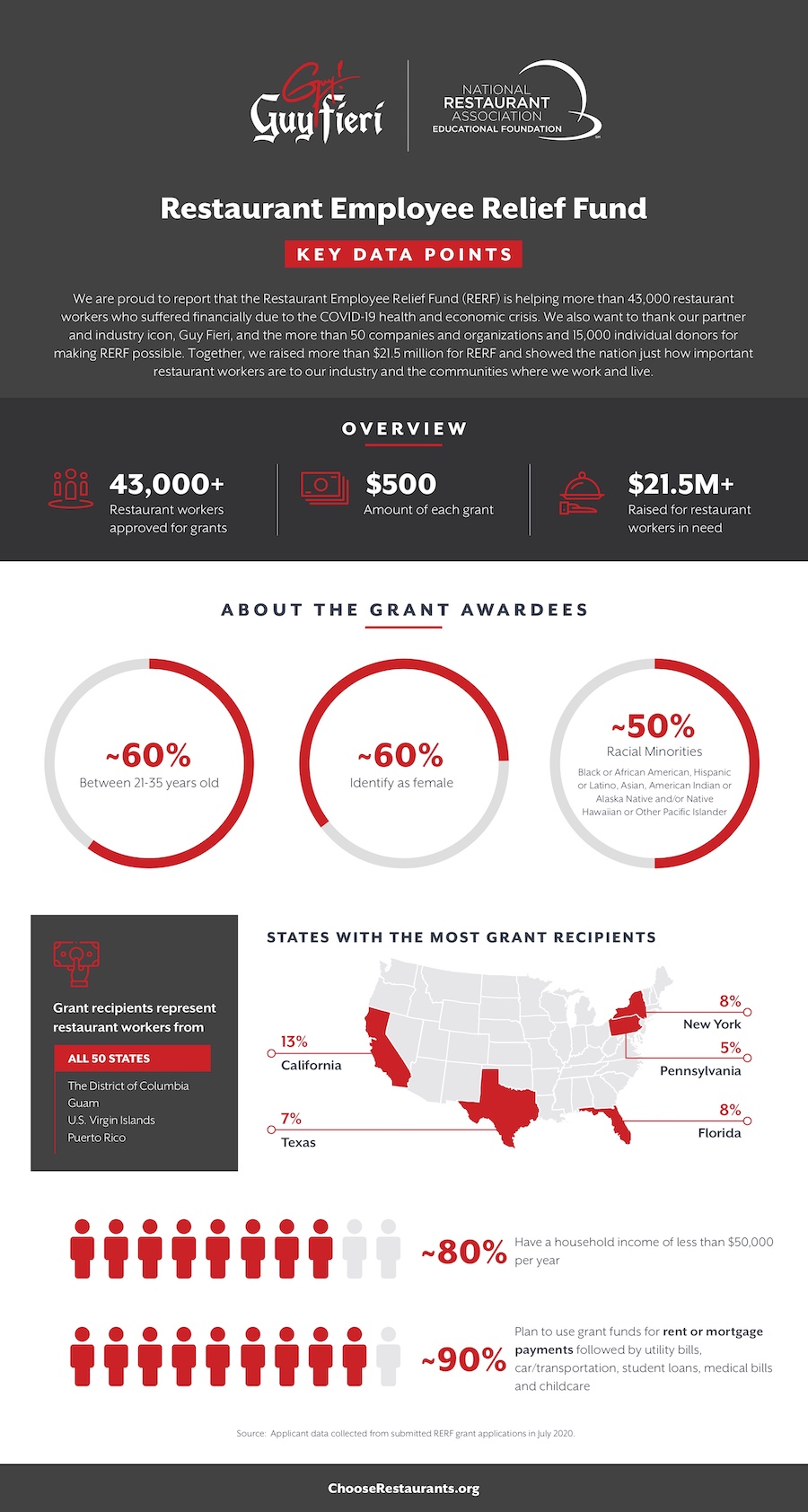

We are proud to report that the Restaurant Employee Relief Fund (RERF) is helping more than 43,000 restaurant workers who suffered financially due to the COVID-19 health and economic crisis. We also want to thank our partner and industry icon, Guy Fieri, and the more than 50 companies and organizations and 15,000 individual donors for making RERF possible. Together, we raised more than $21.5 million for RERF and showed the nation just how important restaurant workers are to our industry and the communities where we work and live.

RERF’s Impact

One-time $500 grants are being provided to restaurant workers in all 50 states, the District of Columbia, Guam, the U.S. Virgin Islands and Puerto Rico. Approximately 60 percent of recipients are between the ages of 21 and 35 and nearly 60 percent identify as female. Fifty percent of grants went to racial minorities. Eighty percent of grant recipients reported earning less than $50,000 per year in household income before being impacted by the COVID-19 pandemic. The Fund is now closed for new applications and our team is busy ensuring all awardees receive and access their RERF grant checks.

Guy Fieri’s Impact

Guy Fieri made The Bloomberg 50 list of people who defined an unprecedented year for his help in raising more than $21.5 million to assist unemployed restaurant workers through our Restaurant Employee Relief Fund. Click below to learn more and to explore the other game-changers of this year.

Thank You RERF Supporters!

RERF Supporters

ABOUT THE

National Restaurant Association Educational Foundation

As restaurants begin to slowly reopen, the work of the National Restaurant Association Educational Foundation (NRAEF) is more important than ever. For the past 33 years, we have been attracting, empowering, and advancing today’s and tomorrow’s restaurant workers. Our programs include: scholarships; job training for those reengaging and reentering their communities; high school culinary arts and restaurant management technical education; apprenticeships; and training for U.S. military service members transitioning into the civil restaurant industry.

Our nation’s restaurant workers will continue to face unprecedented challenges in the months and years ahead. With the support of our partners and individuals who are passionate about this industry, NRAEF can keep creating opportunities for anyone who wants to build their future in restaurants.

Learn more about NRAEF at: ChooseRestaurants.org

Applicant FAQs

Is the RERF accepting new applications?

The Restaurant Employee Relief Fund is no longer accepting applications. The Fund raised more than $21.5 million and is currently in the final stages of processing one-time $500 grants for over 43,000 eligible restaurant workers. All applicants who met the eligibility requirements were funded.

Is the RERF accepting donations?

The Fund is no long accepting donations. Donations can be made to support the ongoing work of the National Restaurant Association Educational Foundation (NRAEF) and its programs. Click here for more information.

I have not received my RERF grant check – what should I do?

If you received a RERF award notification, your check is on the way. All grant recipients have been notified of their status via email (if you did not receive a status email, please check your junk/spam folder). Your check will be sent to the mailing address you provided on your application. Please allow 6 to 8 weeks for your check to arrive – we cannot track checks once they have been mailed.

I am having difficulty depositing my RERF check – what should I do?

If you are trying to deposit your RERF check via a mobile banking app, you may experience an error message. If this occurs, please contact your bank directly for help. If you are still unable to deposit and/or cash your RERF grant check, please submit a written request for assistance at rerf@nraef.org – this inbox is for RERF grant check issues only.

Is my RERF grant a loan? If so, will I be required to pay it back?

Your RERF grant is a one-time $500 award to assist you financially while you are unemployed or have lost significant income due to the COVID-19 pandemic. It is not a loan and does not require repayment.

Does receiving a RERF grant change my unemployment benefits?

Unemployment benefits vary by state. Please check with your local benefits office or caseworker to determine if receiving a RERF grant will affect your current or pending unemployment benefits.

Are these funds considered taxable income?

Income tax requirements vary by state. We recommend checking with a tax professional, Certified Public Accountant (CPA), tax lawyer, or tax preparation service for guidance on how to report your RERF grant when filing your state and federal taxes.

Are there other resources that help restaurant workers?

- You can check out the “Hospitality Relief Dashboard”, a state-by-state guide that features information on a variety of organizations and resources dedicated to helping and supporting restaurant, foodservice, and hospitality workers.

- The Ohio Restaurant Association has an active Restaurant Relief Fund. (The Hospitality Relief Dashboard and other relief funds are not affiliated with RERF and/or the NRAEF).

- The California Restaurant Association Foundation’s “Restaurants Care” initiative is an established emergency assistance fund for California restaurant workers, year-round.